NYSE: GDDY | 90% Recurring Revenue & Retention Rate for An Essential Service

Growing share cannibalizer

Executive Summary:

90% recurring revenue and retention rate for an essential service; In recent years, GoDaddy has expended its product and service offering to become a full fledge digital marketing platform to serve entrepreneurs, diversifying its’ recurring revenue stream and creating a full service platform with high switching costs. Management is targeting 33% EBITDA margins and $5B in revenue by 2026.

At a share price of $140~, GoDaddy is currently trading at 5%~ TTM EBITDA/EV earnings yield. Earnings quality is high; FCFF as % of EBITDA is 95%~ From 2020 to 2023, GoDaddy has grown FCFF/Share from $4.3 to $7.5 by using almost all of its excess free cash flow to buy back $3.5B~ of shares and shows no sign of stopping (bought back $128M in Q1 2024).

Business is asset light (Capex is <2%) and requires no significant reinvestment; 5 year invested capital of $4b~ while generating $1B in EBITDA. TTM ROIC is 25%~ and FCFF share growth of 20% since 2020.

Business:

GoDaddy is built to serve entrepreneurs by providing easy-to-use products on a single technology platform wrapped with personalized guidance. It reports the business in two segments: 1) Applications & Commerce (A&C); 2) Core Platform. A&C comprises of sales of proprietary software products, website building tools, commerce products, and third-party solutions, often bundled together. Key offerings such as GoDaddy Websites + Marketing, Managed WordPress, and GoDaddy Studio help customers create professional websites, attract customers, sell products, and accept payments online and in-person. Websites + Marketing provides an easy, mobile-optimized tool for building websites and e-commerce stores with customizable templates, while Managed WordPress offers a more powerful website building experience. Core Platform. Core Platform (Core) primarily consists of sales of domain registrations and renewals, aftermarket domain sales, website hosting products and website security products. In 2023, 2022 and 2021, it derived approximately 66%, 69% and 70% of our total revenue, respectively, from sales of Core Platform products. Important to note, GoDaddy is primarily a registrar and not registry; although it does have a subsidiary called GoDaddy Registry. Registries, managed by the Internet Assigned Numbers Authority (IANA) under the Internet Corporation for Assigned Names and Numbers (ICANN), oversee top-level domains (TLDs) like ‘.com’ and ‘.net’ by maintaining records of domain ownership. They delegate domain sales to registrars, who sell domain registrations to users and notify and pay the registry, such as VeriSign for ‘.com’ domains. As an analogy, this relationship is similar to car dealerships and manufacturers; registrars (dealerships) handle transactions and customer service, while registries (manufacturers) manage the production and delivery of domains.

Unlike cars, however, domain names can only be leased, not owned outright.[i] Therefore, continued registration is required to maintain control over a domain. In other words, recurring revenue for an essential service. The proliferation of other Top Level Domains (.ai, .info, .org, .edu), the largest TLDs, Verisign, who owns .com and .net servers are facing much steeper competition; they take a commission for each domain sale & renewal.

As a registrant, GoDaddy is able to be agnostic about the different TLDs and focus on the best domains to sell. It doesn’t matter which car brand is the most popular; GoDaddy can sell them. The risk is held by the registry. As of 2023, GoDaddy has 446 generic TLDs that are available to purchase. In recent years, GoDaddy has grown vertically, expanding domain services to other profitable asset light avenues, and becoming a full service digital marketing platform for customers. Its’ strategy, starting with selling a domain, creates an easy avenue for cross selling other products and services, which translates to lower customer acquisition costs. Customer’s switching cost is higher because all of their information and data are integrated in one application, creating synergies that are difficult to achieve if multiple applications are used, a natural stickiness to GoDaddy’s products, and higher lifetime value customers. From 2021 to 2023, A&C as a % of revenue increased from 29.6% to 33.6%, evidence that customers see value in their offerings. GoDaddy knows the value of having an end to end platform and recently changed their overall mission to “serving a large market of entrepreneurs, developing and delivering easy-to-use products in a one-stop shop solution alongside personalized guidance.”

GoDaddy’s largest customers are Independents (business owners), Web Pros, Domain Registrars and Investors, and Third Party Registrars and Corporate Domain Portfolio owners. From 2020 to 2023, ARPU (Average Revenue Per User) increased from $170 to $203 as total customer served grew from 20.1M to 21M. ARR as a % of total revenue is 88%~; total bookings increased from $4.2B to $4.6B excluding refunds; net retention rate for a customer who has been with GoDaddy for over 3 years is 90%.

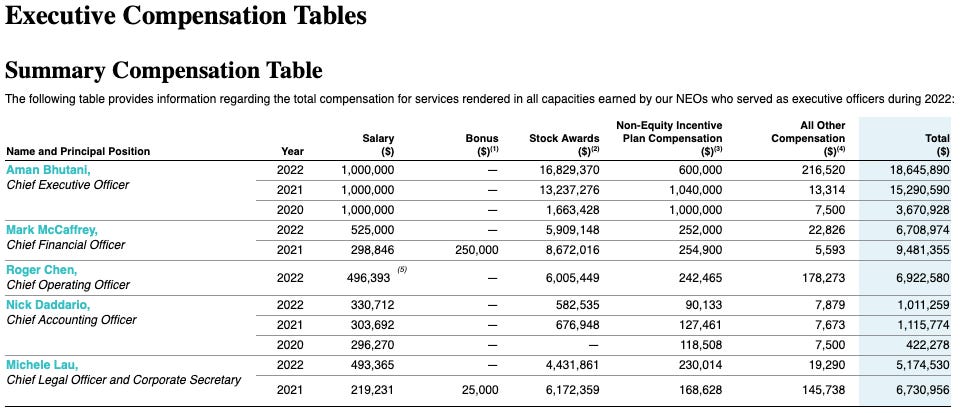

Executive tenure at GoDaddy is relatively short. Aman Bhutani, CEO, has been with GoDaddy for 5 years, and from 2021 to 2022, Aman appointed a new CFO, CLO, and COO. Previously, Aman was President of Brand Expedia Group, and SVP at JP Morgan. During his tenure, GoDaddy’s share price has increased by 87%, from $74 to $140. However, share price increase is primarily from past year performance. Although insider ownership is insignificant, executive compensation is well incentivized. Majority of the compensation is in the form of stock options, and STIP (Short Term Incentive Plan) is primarily an equal weighted composite of bookings and unlevered free cash flow, which are good management incentives.

From 2020 to 2023, Revenue increased from $3.3B to $4.3B, a 33% increase, while operating expenses only grew 10%, from $1.8B to $2B. EBITDA margins grew from 21.8% to 26.7%. Business is asset light; Capex is < 2% of revenue. Therefore, reinvestment required is minimal to grow the business. Working capital is efficient as subscription models allows for cash to be earned up front ($3B of deferred revenue). Earnings quality is high; FCF/NI 95%~100%. As such, management has been deploying excess cash to continuously repurchase shares, reducing outstanding shares from 173M to 141M (Q1 2024) and returning $3.6B to shareholders. As a result, FCF per share grew from $3.65 to $7.5. Q1 2024 total invested capital is $4.2B compromising of $3.8B ($3.1B net cash) of long term debt due in 2027/2029 and $0.4B of equity. With growing healthy EBITDA and FCF margins, solvency is not a concern even though the company is very leveraged. GoDaddy generated an average of $1B FCFF a year and $2.5B Gross Profit with roughly $4B in invested capital during the same time period. Management is targeting 6-8% revenue growth, 33% EBITDA Margins, 20% FCF/Share growth. These goals are realistic given GoDaddy’s accomplishment thus far.

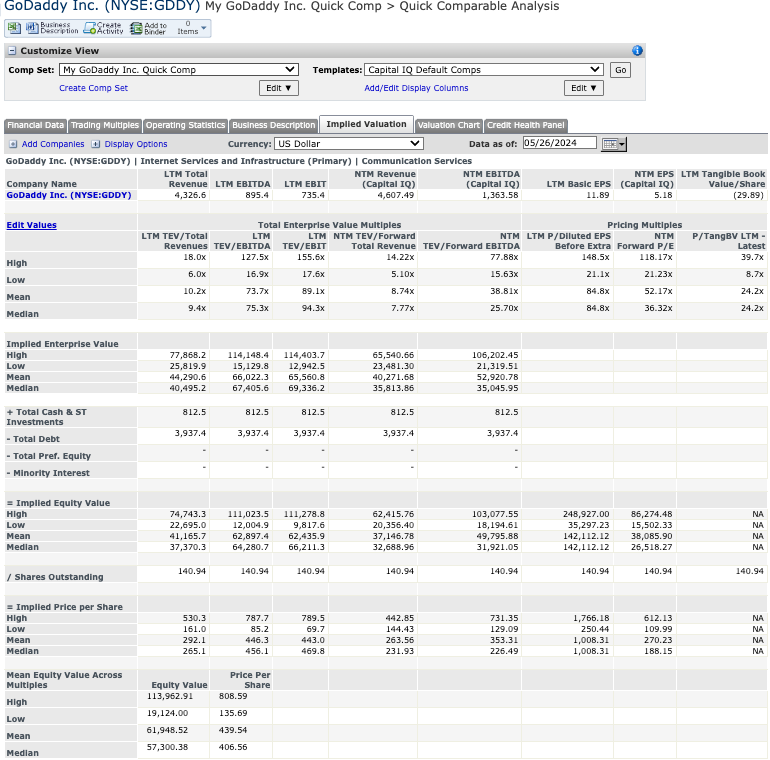

Using a 5 year RIM valuation with an 8.5% discount rate, 18% long term growth rate, and a sustainable dividend payout ratio of 35%, the share price is $171, a 22% undervaluation to current price. However, GoDaddy cashflow is significantly less volatile as 88% of revenue is recurring in nature; therefore, the cashflow should be discounted with a lower discount rate than the median implied cost of capital, providing an additional margin of safety to valuation. Relative to peers, GoDaddy is also trading below the mean and median revenue, EBITDA, and FCF multiples. Undervaluation aside, share price growth is highly probable given current trading price of $140 (5%~ FCFF/earnings yield) while management has been growing FCFF/Share at 20% a year since 2020 through improved core operations and large share buybacks.

Disclaimer: The information provided here is for informational purposes only and should not be considered as financial advice. Investing and making financial decisions come with risks, so it's crucial to do thorough research and consult with a qualified financial professional before making any investment decisions.

Appendix

P123 Tech Rank

Forward Forecast

FCF to EBITDA

ARPU

LTV

Core Platform

Management Compensation

Income Statement

Total Bookings

Total bookings. Total bookings is an operating metric representing the total value of customer contracts entered into during the period, excluding refunds. We believe total bookings provides additional insight into the performance of our business and the effectiveness of our marketing efforts since we typically collect payment at the inception of a customer contract but recognize revenue ratably over the term of the contract.

Total customers. We define a customer as an individual or entity with paid transactions in the trailing twelve months or with paid subscriptions as of the end of the period. A single user may be counted as a customer more than once if they maintain paid subscriptions or transactions in multiple accounts. Total customers are one way we measure the scale of our business and is an important part of our ability to increase our revenue base.

Capital Structure

NEBITDA

Free Cash Flow

GoDaddy RIM Valuation

Comp Multiples

Implied Valuation

[i] https://www.cloudflare.com/learning/dns/glossary/what-is-a-domain-name-registrar/